Dear Clients,

This message is important for clients that have British Virgin Islands (BVI) “struck-off companies”. We would like to remind you that any BVI companies that were struck-off before the amendments to the BVI Business Companies Act (BVI BC Act) came into effect on January 1, 2023 (referred to as “existing struck-off companies”), that are not restored by June 30, 2023, will be dissolved automatically on July 1, 2023.

It is important for clients to understand the requirements for restoration of dissolved companies under the provisions of the amended BVI BC Act as there have been some changes.

The law now provides the option of restoration of dissolved companies via the BVI Registry, an option that was previously not available prior to the amendments to the BVI BC Act. However, certain requirements must be met.

If a dissolved company cannot be restored via the BVI Registry, it can be restored via the BVI Courts. However, this is ultimately at the discretion of the Court.

Below is a guide to the requirements in both cases.

- Restoration via the BVI Registry.

A dissolved company can be restored via the BVI Registry if the following conditions are met:

-

- The company was carrying on business or in operation at the date of its striking off and dissolution.

- A registered agent has agreed to act as such for the company.

- The registered agent has made a declaration that the company’s corporate and due diligence records have been updated.

- If, following the striking off and dissolution of the company, any property of the company has vested in the Crown, the Financial Secretary:

- has confirmed the Crown’s consent to the company’s restoration; or

- has, within 7 days of receiving a request to give the Crown’s consent to the company’s restoration, failed to respond to the request.

- The company has paid the restoration fee and any outstanding penalties in relation to the company; and

- The Registrar is satisfied that it would be fair and reasonable for the company to be restored to the Register.

- Restoration via the BVI Courts

A dissolved company can be restored via the BVI Courts if the following conditions are met:

- The company was struck-off and dissolved following the completion or termination of its voluntary liquidation under the BVI BC Act, or liquidation under the Insolvency Act.

- On the date of dissolution, the company was not carrying on business or in operation.

- The purpose of restoration is to

- initiate, continue, or discontinue legal proceedings in the name of or against the company; or

- make an application for the company’s property that has vested in the Crown to be returned to the company, or

- In any other case not falling under paragraph (a), (b), or (c) above, or in which application cannot be made to the Registrar, the Court considers that having regard to any particular circumstances, it is just and fair to restore the company.

Please note that existing struck-off companies that are dissolved and need to be restored via the BVI Courts (see above) are liable to pay a penalty of USD $5,000, in addition to any other outstanding fees and penalties.

Who can apply for restoration of a dissolved company via the BVI Courts?

Application for restoration of a dissolved company via the BVI Courts can be made by:

-

- The Attorney General or any other competent authority in the BVI.

- A creditor, former director, former member, or former liquidator of the company.

- A person who but for the company’s dissolution would have been in a contractual relationship with the company.

- A person with a potential legal claim against the company.

- A manager or trustee of a pension fund established for the benefit of employees of the company; or

- Any other person who can establish an interest in having the company restored to the Register.

Who can act as liquidator of a BVI Company

Liquidators of BVI companies must meet the following requirements:

-

- Have been resident in the BVI for a minimum of 180 days.

- Have experience as a liquidator for a minimum of 2 years.

- Hold all necessary qualifications.

- Have in-depth knowledge of the BVI FSC and BVI BC Act.

Next steps

If you would like to restore an existing struck-off company to avoid automatic dissolution of the company on 1st July 2023, please contact your customer service representative as soon as possible or contact us at: [email protected].

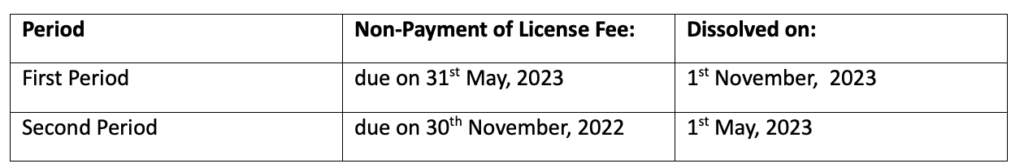

Please note that relevant dates for dissolution of companies struck-off for non-payment of annual license fees are as follows:

If you require assistance or require additional information, please contact your customer services representative or relationship manager at [email protected].